Expressed another way, the contribution margin ratio is the percentage of revenues that is available to cover a company’s fixed costs, fixed expenses, and profit. If the total contribution margin earned in a period exceeds the fixed costs for that period, the business will make a profit. If the total contribution margin is less than the fixed costs, the business will show a loss. In this way, contribution margin becomes an important factor when calculating your break-even point, which is the point at which sales revenue and costs are exactly even ($0 profit).

How Do You Calculate the Contribution Margin?

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period.

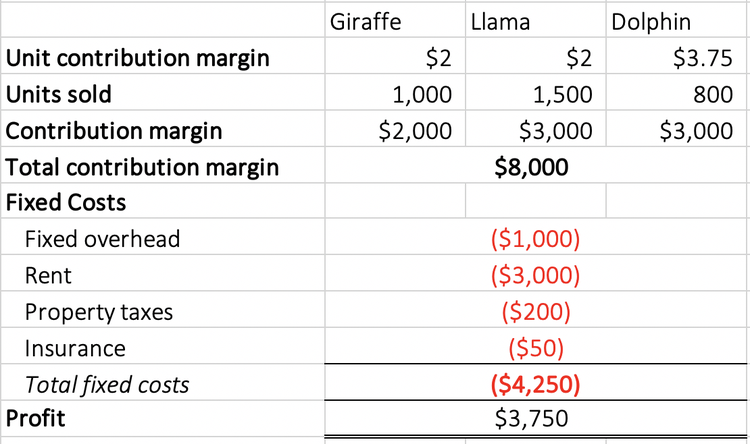

How does the contribution margin affect profit?

The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms. The answer to this equation shows the total percentage of sales income remaining to cover fixed expenses and profit after covering all variable costs of producing a product. The Contribution Margin Ratio is a measure of profitability that indicates how much each sales dollar contributes to covering fixed costs and producing profits. It is calculated by dividing the contribution margin per unit by the selling price per unit. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs.

To Ensure One Vote Per Person, Please Include the Following Info

However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. Say a machine for manufacturing ink pens comes at a cost of $10,000. Sales (a.k.a. total sales or revenue) is the monetary value of the goods or services sold by your business during a certain reporting period (e.g., quarterly or annually). Look at the contribution margin on a per-product or product-line basis, and review the profitability of each product line.

Contribution Margin Ratio: Definition, Formula, and Example

Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

- As the first step, we’ll begin by listing out the model assumptions for our simple exercise.

- Thus, you will need to scan the income statement for variable costs and tally the list.

- This means the higher the contribution, the more is the increase in profit or reduction of loss.

- This is because the contribution margin ratio lets you know the proportion of profit that your business generates at a given level of output.

How confident are you in your long term financial plan?

On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. The contribution margin is affected by the variable costs of producing a product and the product’s selling price. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually how to manage timesheets in xero contributing to profits. It means there’s more money for covering fixed costs and contributing to profit. That can help transform your labor costs from a variable expense to a fixed expense and allow you to keep those expenses under tighter control. As a result, your variable expenses will go down and your contribution margin ratio will go up.

It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time.

In order to help you advance your career, CFI has compiled many resources to assist you along the path. Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers. Find out what a contribution margin is, why it is important, and how to calculate it. Learn about the time interest earned ratio and how to calculate it.

These costs would be included when calculating the contribution margin. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior.